Syllabus Edition

First teaching 2025

First exams 2027

Understanding Money (Cambridge (CIE) IGCSE Economics): Revision Note

Exam code: 0455 & 0987

The meaning of money

Prior to the creation of money, individuals and firms had to accept other goods or services as payment, or be self-sufficient by producing everything required

Lacking self-sufficiency or driven by the desire for a wider range of goods and services, bartering became the norm but it too had problems

As individuals and firms trade with each other in order to acquire goods or raw materials, they require a means of exchange that is acceptable and easy to use

Modern currency fulfils this purpose

The forms of money

Cash – coins and banknotes used for everyday transactions

Bank deposits – money held in bank accounts, accessible via cheques, debit cards, or online transfers

Electronic money – digital payments, mobile banking, and online currencies

Near money – assets that can be quickly converted into cash (e.g. savings accounts)

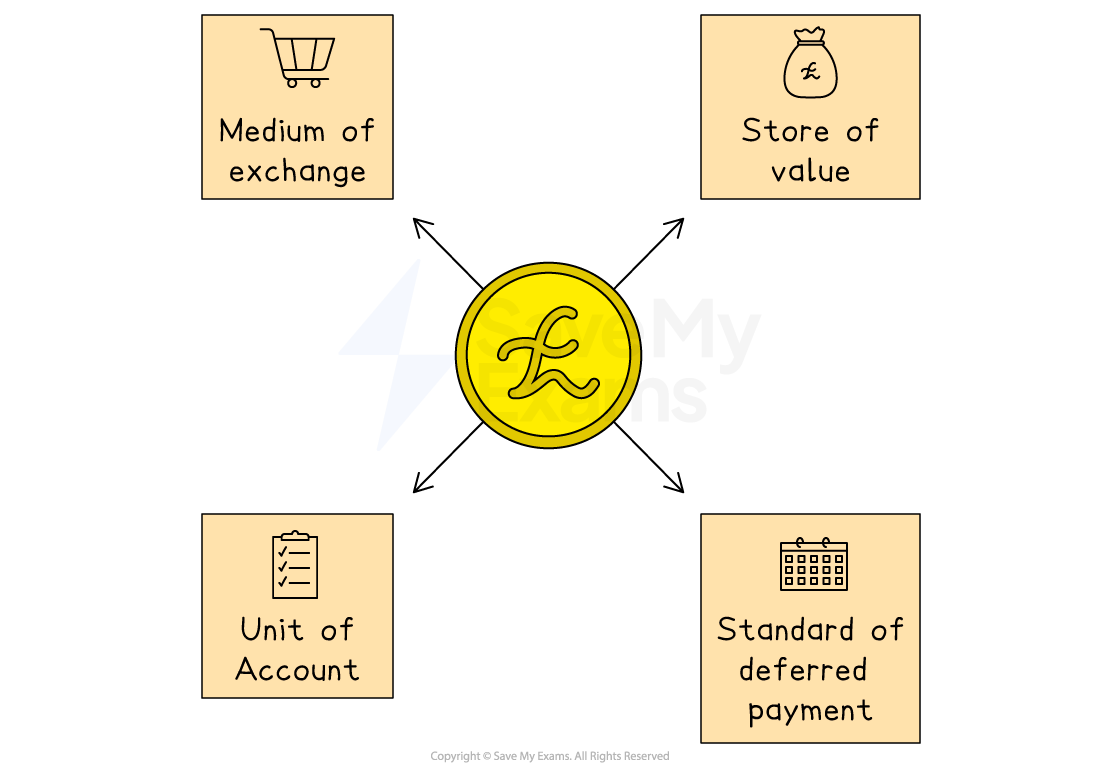

The functions of money

In order to be effective, modern currency has to fulfill four uses (functions)

The four functions of money

1. A medium of exchange

Without money, it becomes necessary for buyers and sellers to barter (exchange goods)

Bartering is problematic as it requires two people to want each other's goods (double co-incidence of wants)

Money easily facilitates the exchange of goods, as no double co-incidence of wants is necessary

2. A measure of value (unit of account)

Money provides a means of giving a value to different goods and services

Knowing the price of a good in terms of money allows both consumers and producers to make decisions in their best interests

Without this measure it is difficult for buyers and sellers to arrange an agreeable exchange

3. A store of value

Money holds its value over time (of course inflation means that is not always true!)

This means that money can be saved

It remains valuable in exchange over long periods of time

4. A method of deferred payment

Money is an acceptable way to arrange terms of credit (loans) and to settle any future debts

This allows producers and consumers to acquire goods in the present and pay for them in the future

The characteristics of money

Many items were used for centuries as a form of money, such as gold, silver, shells, beer and tobacco

However, each one of these items had some characteristics that made them less than ideal for exchange in certain circumstances

Good money has a number of essential characteristics – and modern currency fulfils them all

Divisibility

To be a valued medium of exchange, currency must be divisible. €50 notes can be exchanged for €10 euro notes or €1 coins

Acceptability

The currency must be valued and widely accepted by society as a valid way to pay for goods/services

Durability

The currency must be robust, not easily defaced or destroyed and last for a long period of time

Scarcity

The supply of the currency should be such that it remains desirable and retains its value in the market. Oversupply would decrease its worth

Uniformity

In order to be a valid measure of value, each denomination must be exactly the same, e.g., every $50 note must be exactly the same

Portability

Good currency is easy to carry or conceal

Examiner Tips and Tricks

MCQ often checks your understanding of this topic. Be careful not to confuse the functions and characteristics of money.

Unlock more, it's free!

Was this revision note helpful?