Syllabus Edition

First teaching 2025

First exams 2027

Macroeconomic Aims (Cambridge (CIE) IGCSE Economics): Revision Note

Exam code: 0455 & 0987

An introduction to macroeconomic aims

The macroeconomic aims of government are the main long-term objectives they strive to achieve to promote a healthy and sustainable economy

They include:

Economic growth

Increasing the total output of goods and services over time

Full employment / low unemployment

Ensuring that as many people as possible who are willing and able to work have jobs

Stable prices / low inflation

Keeping the general level of prices steady to protect purchasing power

Balance of payments stability

Maintaining a healthy trade and financial position with the rest of the world

Redistribution of income

Reducing excessive inequalities in income and wealth

Environmental sustainability

Supporting growth that preserves natural resources and protects the environment

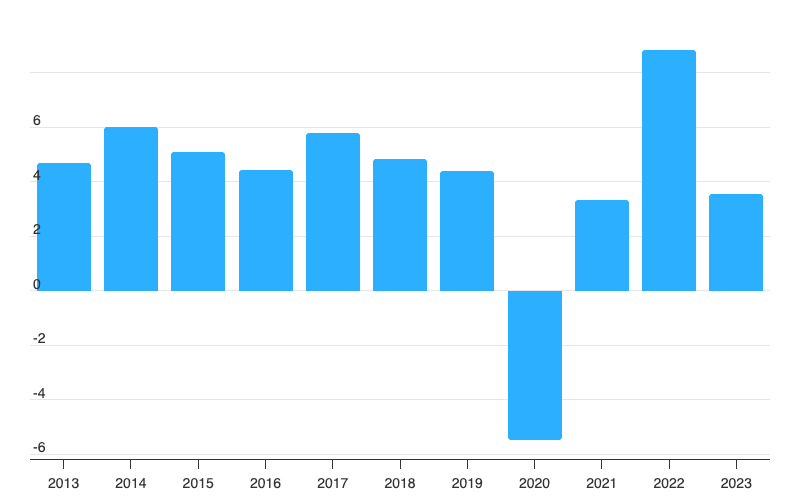

Economic growth

Economic growth is a central macroeconomic aim of most governments

Many developed nations have an annual target growth rate of 2-3%

This is considered to be sustainable growth

Growth at this rate is less likely to cause excessive demand pull inflation

Politicians often use it as a metric of the effectiveness of their policies and leadership

Economic growth has positive impacts on confidence, consumption, investment, employment, incomes, living standards and government budgets

Source: Macrotrends (opens in a new tab)

Explaining Malaysia's growth trends 2013 - 2023

2014 - 2016 | 2017 - 2019 | 2020 | 2022 |

|---|---|---|---|

|

|

|

|

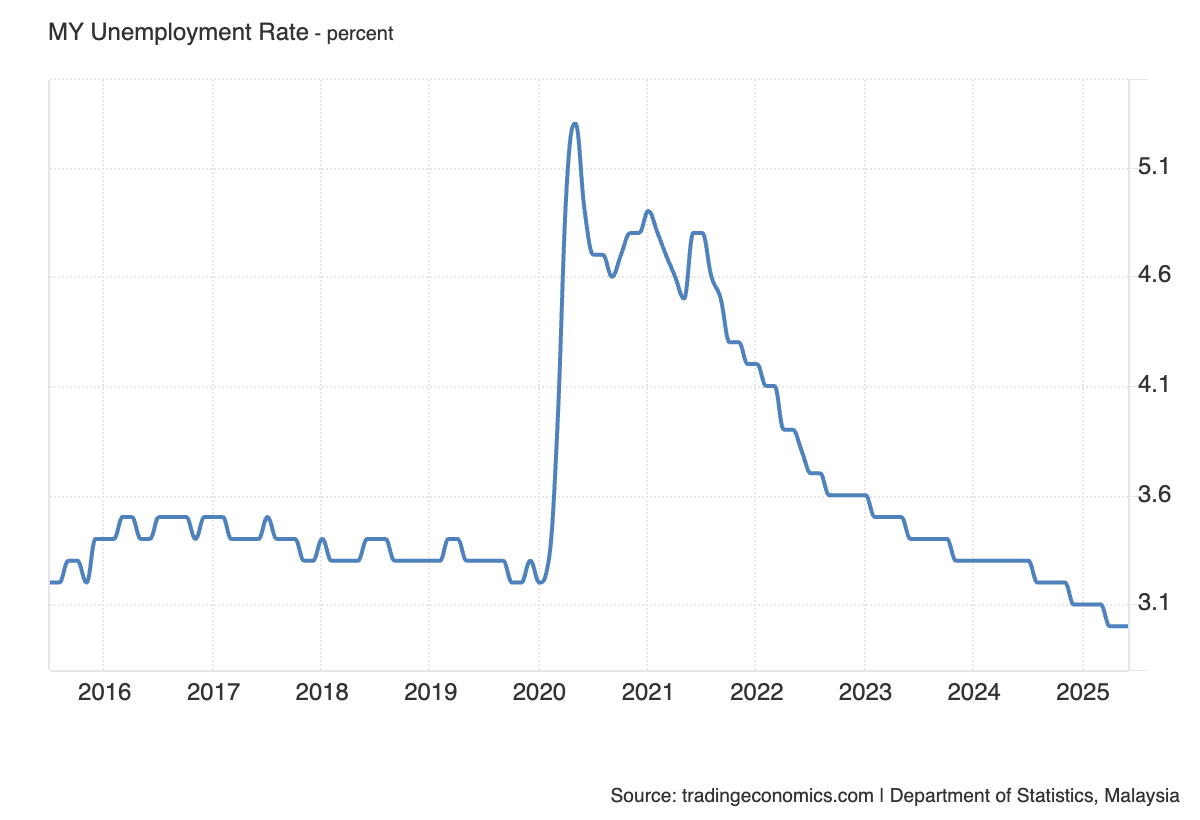

Low unemployment

Someone is considered to be unemployed if they do not have a job and are actively seeking one

The target unemployment rate often depends on the size of the economy

E.g. India finds a rate of 6.5% good, whereas Singapore aims for it to be under 2%

The closer an economy is to the full employment level of labour, the better (more efficiently) it is using its human resources

Within the broader unemployment rate, there is an increased emphasis on the unemployment rate within different sections of the population

For example, youth unemployment, ethnic/racial unemployment by group

In 2021, black unemployment in the USA was 8.7% and white unemployment was 4.7%

Unemployment tends to be inversely proportional to real GDP growth

When real GDP increases, unemployment falls

When real GDP decreases, unemployment rises

Source: Trading Economics (opens in a new tab)

Chart analysis

2016–2019:

The unemployment rate remained stable at around 3.3–3.5%, indicating a steady labour market

Early 2020:

Slight dip before a sharp spike to over 5% — most likely due to the economic disruption caused by the Covid-19 pandemic and lockdown measures

2021–2022:

Gradual but uneven decline in unemployment, with small fluctuations suggesting partial recovery and intermittent economic disruptions

2022–2025:

Continuous and steady decline, reaching around 3.1% in 2025, indicating strong post-pandemic recovery and possible job creation from economic reopening

Overall trend:

Long-term stability before pandemic → sharp short-term shock → gradual recovery → return to pre-pandemic unemployment levels

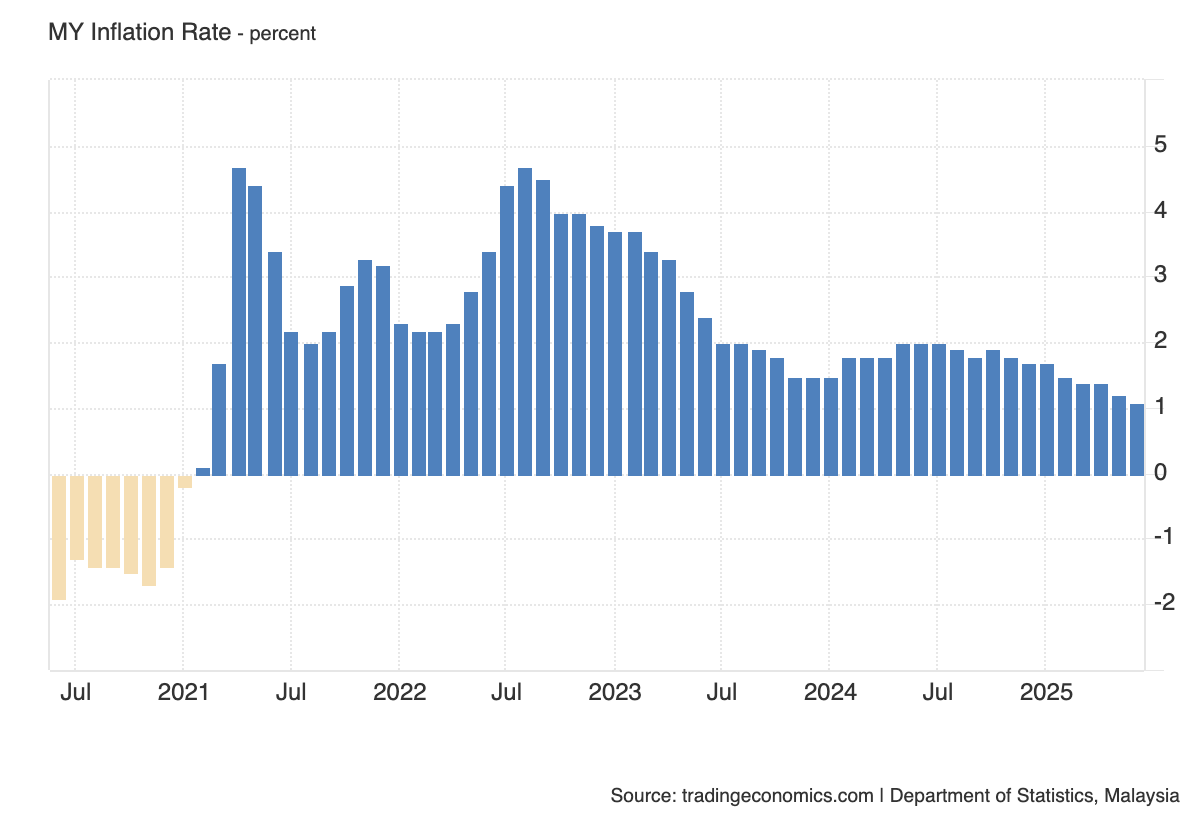

Low and stable rate of inflation

Most economies have a target inflation rate of 2% using the Consumer Price Index (CPI)

A low rate of inflation is desirable, as it is a symptom of economic growth

The different causes of inflation (cost-push or demand-pull) require different policy responses from the government

Demand-side policies ease demand-pull inflation

Supply-side policies ease cost-push inflation

Source: Trading Economics (opens in a new tab)

Malaysia experienced a continual deviation from the target of 2% between July 2021 and July 2023

An inflation rate in July 2022 of 4-5% was considered to be unstable, eroding household purchasing power

A low and stable rate of inflation is important, as it

Allows firms to confidently plan for future investment

Offers price stability to consumers

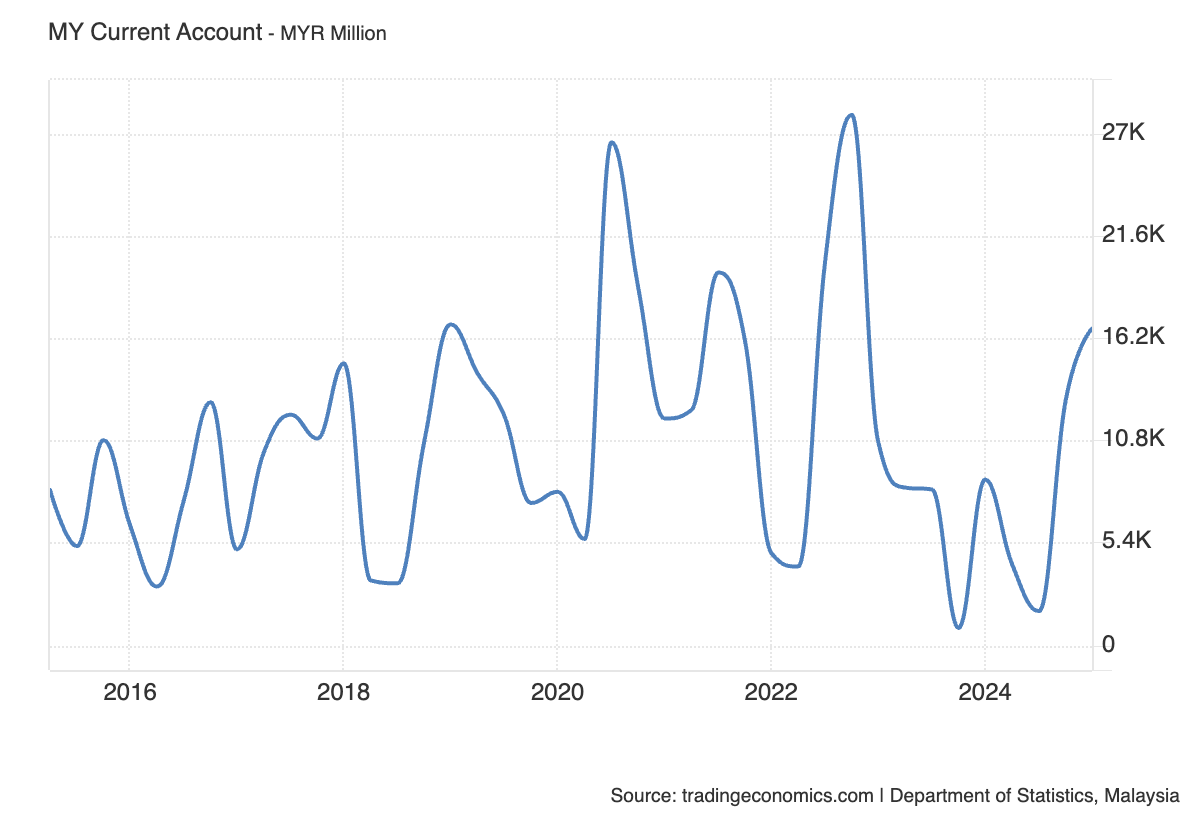

Balance of payments stability on the current account

The Balance of Payments (BoP) for a country is a record of all the financial transactions that occur between it and the rest of the world

The current account focuses mainly on the financial transactions related to exports and imports of goods and services

Governments aim for Balance of Payments equilibrium on the Current Account

If exports > imports it will create a current account surplus

If imports > exports, it will create a current account deficit

Each one of these conditions has advantages and disadvantages associated with it

However, a current account deficit is more problematic in the long-run than a surplus

Malaysia's current account position 2016 to 2024

Source: Trading Economics (opens in a new tab)

Chart analysis

General trend:

The current account balance has shown regular fluctuations, reflecting seasonal trade patterns and changes in global demand for Malaysia’s exports

Overall, Malaysia has maintained a surplus for most of the period, meaning it exports more goods, services, and capital than it imports

2016–2019:

Moderate surpluses with a repeating up-and-down cycle

2020:

Strong increase in surplus early in the year, likely due to reduced imports during the COVID-19 pandemic and resilient export demand for certain products such as electronics and medical gloves

2021–2022:

Sharp peaks, with one of the highest surpluses in the observed period, likely boosted by high commodity prices (e.g. palm oil) and strong electronics exports

Followed by significant drops, indicating volatility from global market shifts and possible import rebounds

2023–2024:

Marked decline in the surplus, with some quarters approaching very low or near-zero balances, possibly due to falling commodity prices, weaker export demand or higher imports as domestic demand recovered

Late 2024:

Strong rebound in the current account surplus, signalling a recovery in export performance or a reduction in imports

The redistribution of income

The redistribution of income aims to reduce income inequality in an economy

High levels of income inequality can create social unrest which may ultimately lead to revolutions

Perfect income equality is not desirable, as it removes the incentive to work and study

Governments aim to redistribute income by taxing the wealthy and providing welfare payments to the poor

Unchecked capitalism has a natural outcome of high income inequality

The wealthy are able to keep buying factors of production

The concentration of ownership becomes more and more narrow, with fewer individuals owning the bulk of the world's wealth

There is a need for governments to intervene to maintain acceptable levels of income inequality

Absolute poverty is usually worse in developing countries. However, in a developed economy such as Germany, a 1% increase in income inequality can push a lot more households into relative poverty

Environmental sustainability

Environmental sustainability aims to ensure that economic growth and development do not deplete natural resources or cause long-term damage to the environment

Perfect environmental preservation is not possible, as some resource use is inevitable in any economy, but the aim is to keep resource consumption within levels that the planet can naturally replenish

Unchecked industrial activity can lead to pollution, resource depletion and climate change, all of which can harm future generations

Environmental degradation often disproportionately affects poorer countries, which may lack the infrastructure or governance to mitigate the effects of, for example, rising sea levels or extreme weather events

Governments aim to protect the environment through legislation, regulation and incentives

For example, setting emissions limits, taxing pollution or subsidising renewable energy

Unchecked capitalism has a natural outcome of overusing common resources as firms and individuals pursue short-term profit without considering long-term environmental costs

There is a clear need for governments to intervene to protect biodiversity, reduce greenhouse gas emissions and promote sustainable consumption and production patterns

Unlock more, it's free!

Was this revision note helpful?