Industry Insights & Trends: The E-waste Industry (DP IB Business Management): Revision Note

Market size and growth

E-waste means unwanted or discarded electronic products

Examples include old phones, computers, TVs, tablets, cables and game consoles

The amount of e-waste produced worldwide is very large and increasing quickly

Around 62 million tonnes of e-waste were produced globally in 2022

This is expected to increase to over 80 million tonnes by 2030

Only a small share of e-waste is recycled properly

Just over 20% is formally collected and recycled

The rest is often dumped in landfill or handled informally

This creates strong growth potential for the e-waste processing industry

Governments want higher recycling rates

Firms see opportunities to recover valuable materials

The global e-waste recycling industry is worth tens of billions of dollars and there is a large and fast-growing global market

Leading companies and brands

The industry includes two main types of big players

Electronics recyclers / IT asset disposal firms

Collect, sort, wipe data and pre-process devices

Metal smelters/refiners

Recover high-value metals (gold, silver, palladium, copper) from e-waste

Some companies operate globally, while others focus on one country or region

Examples of major international companies

These companies often work with governments, electronics manufacturers and large businesses replacing IT equipment

|  |

|---|---|

Specialises in recycling copper and electronic materials | Operates recycling facilities in many countries |

|  |

Recovers precious metals such as gold and silver from electronic waste | Runs large facilities that recycle circuit boards and electronic parts |

Product types and consumption trends

E-waste processors do not usually sell finished products to consumers

Instead, they sell materials recovered from old electronics to other businesses

Main outputs from e-waste processing include:

Metals, such as copper, aluminium, gold and silver

Plastics, which may be reused or recycled

Reusable devices or parts, if products still work

Demand for e-waste processing is increasing for several reasons

People replace electronic devices more often

New technology becomes outdated quickly

There are more electronic devices per person than in the past

Governments and companies are also under pressure to:

Reduce landfill waste

Meet environmental targets

Show responsible behaviour (CSR)

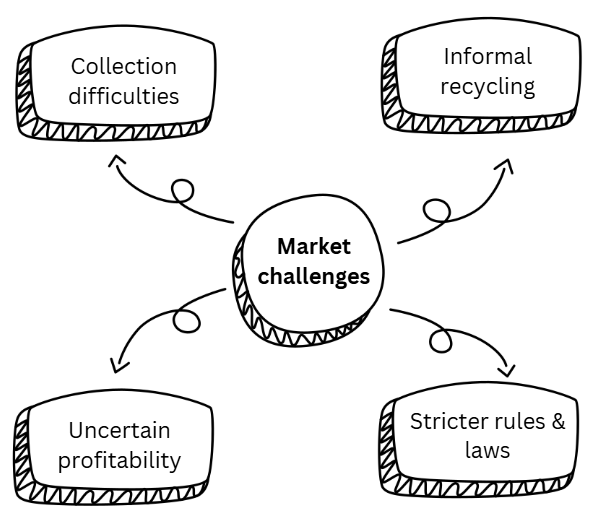

Market challenges

Collection is a major challenge

Even though lots of e-waste exists, much of it is not collected properly

In 2022, only 22.3% was formally collected and recycled globally

This limits how much material formal recycling firms can access

Informal recycling creates problems

In some countries, e-waste is recycled using unsafe methods

This can cause serious health and environmental damage

The World Health Organisation has warned that millions of children and adolescents may be at risk from exposure linked to informal e-waste recycling

Research in Ghana found significant lead exposure risks among people working/living near informal recycling facilities

Informal recyclers often have lower costs, creating unfair competition

Profitability can be uncertain

Recycling profits depend on prices of metals like copper and gold

If metal prices fall, profits may decrease even if recycling volumes rise

Rules and laws are becoming stricter

Governments are tightening controls on exporting e-waste

The EU's Basel Convention entries for shipments affects how e-waste moves internationally.

Firms must meet higher environmental and safety standards

This can increase costs but also protect responsible businesses

Emerging markets and regional insights

Asia produces the largest amount of e-waste worldwide

Nearly half of global e-waste comes from Asian countries

Recycling rates are relatively low, so growth potential is high

Europe has stronger recycling laws

Collection rates are higher than in many other regions

However, some countries still fail to meet official recycling targets

Southeast Asia faces serious challenges

Some countries receive illegal e-waste shipments

Governments are increasing enforcement and banning imports

Malaysia has recently moved to a full ban on e-waste imports and, alongside Thailand, has seized illegal shipments

Africa hosts major informal recycling areas

Recycling often takes place with limited safety equipment

This creates health risks, especially for children

There is growing international pressure to improve conditions

Unlock more, it's free!

Was this revision note helpful?