Economic Influences on Confectionery Businesses (Edexcel A Level Business): Revision Note

Exam code: 9BS0

Inflation and confectionery businesses

Inflation is the situation when prices rise over time, reducing the value of money

Inflation affects confectionery and biscuit firms in two key ways

It raises household living costs, which changes demand

It increases business costs, which squeezes profit margins

Higher inflation

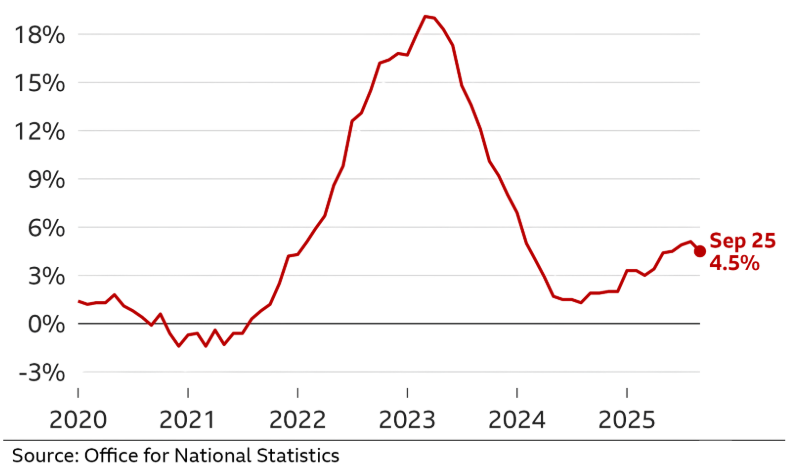

UK CPI inflation was 3.2% in the year to November 2025, which helps explain why many households remain price conscious

During the inflation peak, ONS data shows food inflation was extremely high - more than 19%% in March 2023 - which affected consumers' spending choices on snacks and treats

Food inflation in the UK

Input cost inflation

Input cost inflation affects the amount confectionery and biscuit businesses pay for ingredients, packaging, energy and transport

Commodity prices

Confectionery is especially exposed to global commodity prices (cocoa, sugar, dairy)

UK chocolate prices rose 15.4% in the year to August 2025, with cocoa prices having roughly doubled over two years and cocoa around $7,800 per tonne at the time

The average price per kg of chocolate rose 27% over two years, while consumption fell 2%, showing firms cannot always pass on all cost rises without losing sales

Fuel prices

Rising fuel prices have also increased transport and distribution costs

Higher diesel and fuel costs raise the cost of moving raw materials to factories and finished products to retailers

These higher logistics costs further squeeze profit margins, especially for small firms that lack efficient, large-scale distribution systems

How high inflation changes consumer behaviour

When inflation is high and prices rise quickly, consumers do not usually stop buying confectionery and biscuits altogether

Instead, they change how they buy, as these products are seen as small, affordable treats rather than essential items

Consumers respond by:

buying smaller pack sizes to keep the upfront price low

switching brands or waiting for promotions

reducing how often they buy treats rather than stopping completely

This change in behaviour encourages businesses to adjust their strategies

Selling smaller packs and affordable treat formats at lower price points

Making greater use of price-marked packs and short-term promotions to reassure value-conscious shoppers

Expanding premium product lines for higher-income consumers who are less affected by rising living costs

Exchange rates and confectionery businesses

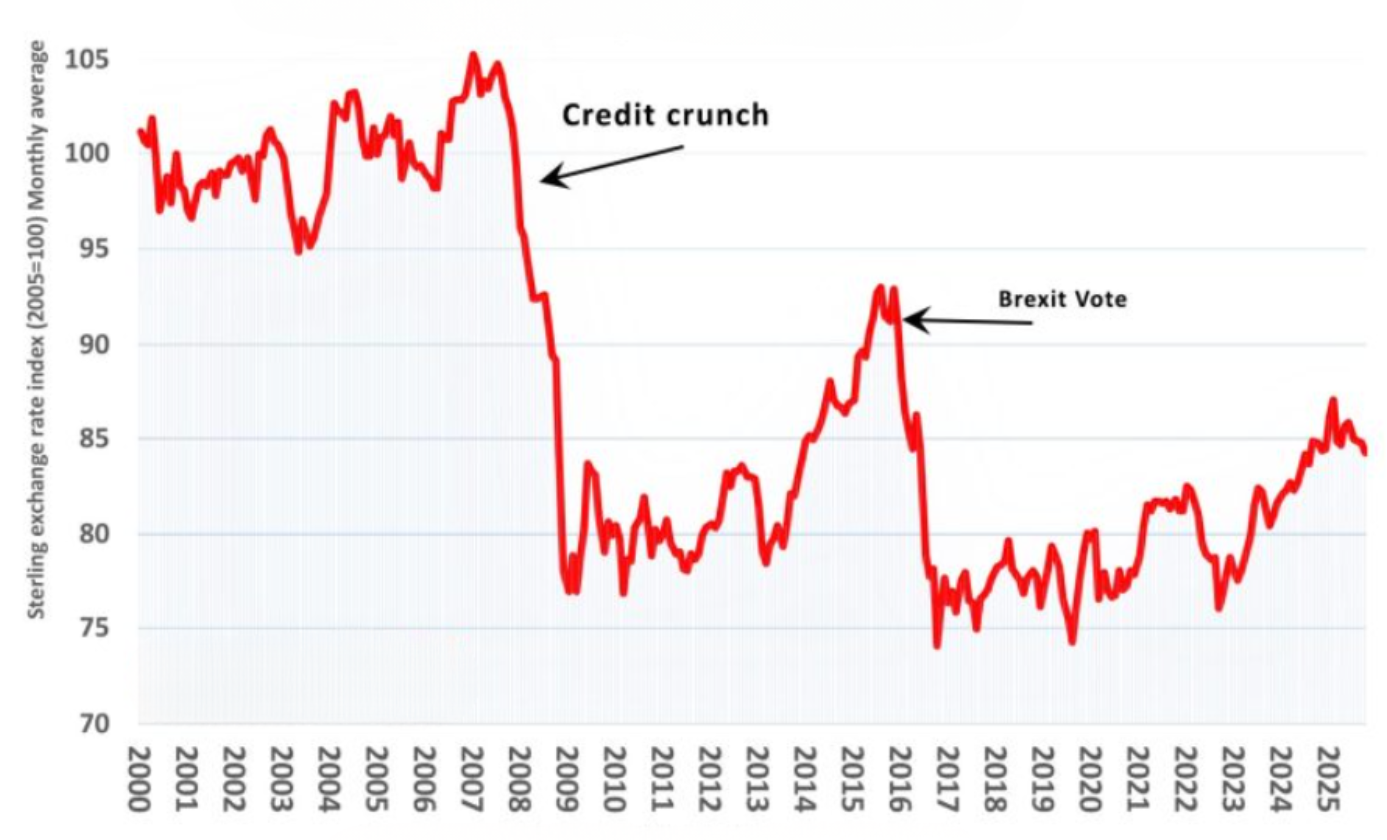

The exchange rate is the value of one currency in terms of another

Exchange rates matter because many key inputs (especially cocoa) are traded globally and priced in foreign currencies, often US dollars

When sterling depreciates, imported ingredients and packaging become more expensivefor UK-based confectionery and business manufacturers

Sterling depreciation increases costs

After the 2016 Brexit referendum, sterling experienced a sharp depreciation and increased volatility, which raised the cost base for import-reliant sectors

For confectionery firms importing cocoa, a weaker pound can increase costs even if global cocoa prices stay the same

Sterling appreciation can ease pressure

If sterling strengthens, import costs can fall, giving firms more room to avoid price rises or rebuild margins

How businesses respond

Larger multinationals are more likely to use financial hedging and global sourcing to manage currency risk

Smaller firms may have fewer options, so they often respond by:

changing pack sizes

adjusting the product mix towards higher profit margin lines

making selective price rises (often easier in gifting/premium than in value market segments)

Interest rates and confectionery businesses

Interest rates are the percentage charged on money borrowed or earned on savings, set by banks and determined by the base rate

Interest rates influence confectionery and biscuit businesses mainly through consumer spending and business finance costs

The Base Rate was increased sharply to tackle inflation, peaking at 5.25% (August 2023) before falling over 2024–2025 to 3.75% (December 2025)

Impact on demand

As interest rates rose sharply in 2022–2023, many UK households faced higher mortgage repayments and borrowing costs

This reduced disposable income and led consumers to become more price-conscious when buying everyday items, including biscuits and confectionery

Shoppers increasingly traded down to supermarket own-label biscuits, which are significantly cheaper than branded alternatives

Consumers relied more on promotions and price-marked packs for branded products

Supermarkets such as Tesco and Sainsbury’s expanded and promoted their own-label biscuit ranges during this period

Branded producers such as pladis (McVitie’s) faced stronger price competition and pressure on sales volumes

Impact on business strategy

When the Bank of England raised interest rates sharply in 2022–2023, borrowing became significantly more expensive

For small confectionery and biscuit businesses operating on tight profit margins, this meant that planned investment was often delayed or scaled back

As a result, some small producers have:

postponed investment in new baking machinery that would increase capacity or efficiency

delayed new product development, as recipe testing and small production runs require upfront funding

reduced spending on marketing and brand awareness, instead relying more on word-of-mouth and social media

Taxation, government spending and confectionery businesses

Taxation is system where a government collects money from people and businesses

Examples include income tax, corporation tax and VAT

Government spending is money used to fund public services

Examples include healthcare, education, and transport or supporting the economy

VAT and pricing

VAT has a direct impact on prices and profitability in the confectionery and biscuit market

Most basic foods are zero-rated, but confectionery is standard-rated at 20%, while biscuits are generally zero-rated unless they are chocolate-covered

This distinction matters because VAT can:

increase final retail prices

reduce demand for VAT-rated products

squeeze profit margins if firms absorb some of the tax

Income tax and consumer demand

Income tax affects the industry indirectly by influencing disposable income

Since 2021, income tax thresholds have been frozen, causing fiscal drag and reducing real household incomes during periods of high inflation

Consumers have become more price-sensitive

Demand has shifted towards own-label products and promotions, reducing demand for branded products

Spending on premium confectionery has become more polarised

Corporation tax and investment

Corporation tax affects profits and reinvestment

The main UK rate rose from 19% to 25% in April 2023, while the Small Profits Rate of 19% applies to firms earning under £50,000

Higher corporation tax reduces retained profit for investment, which limits spending on machinery, product development and marketing

Large multinationals are better able to absorb these costs, while small confectionery and biscuit businesses face greater financial pressure, which can slow growth

Government spending and support schemes

Business energy support

During the 2023 energy price crisis, the government introduced support schemes such as the Energy Bills Discount Scheme, which helped firms manage rising energy costs

This was particularly important for energy intensive confectionery and biscuit manufacturers because production involves baking, cooling, refrigeration, wrapping and storage

Public spending on health and education

Increased funding for public health campaigns can reduce long-term demand for sugary snacks by promoting healthier diets

School food standards and public-sector catering rules can limit where confectionery and biscuits are sold

Infrastructure and transport spending

Investment in roads, ports and logistics infrastructure can lower distribution costs and improve supply reliability

This benefits firms with national supply chains, particularly large manufacturers distributing to supermarkets

Business support and innovation funding

Government grants and schemes for skills, apprenticeships and productivity can support investment in new machinery or training

Smaller firms benefit most where access is straightforward, though many lack awareness or capacity to apply

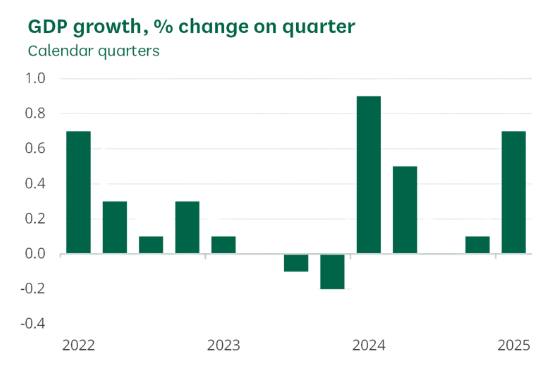

The business cycle and confectionery businesses

The business cycle is the regular pattern of growth and decline in an economy over time, including periods of boom, slowdown, recession and recovery

Resilience, but not immunity

Confectionery and biscuit markets tend to be more resilient than many other sectors over the business cycle because these products are often seen as small, affordable treats

During periods of economic slowdown or recession, consumers are more likely to cut back on big-ticket items such as holidays, cars or home improvements

They continue, however, to buy low-cost indulgences

This resilience does not mean immunity

As the economy moves from growth into slowdown or contraction, consumer behaviour changes

Instead of maintaining previous buying habits, consumers:

reduce how often they buy treats

switch to cheaper brands or own-label products

rely more heavily on promotions and price-marked packs

Premium demand also becomes more polarised during downturns

Some higher-income consumers continue to trade up to premium or ethical products

Others trade down to value options, increasing pressure on mid-priced brands

Impact on small businesses

Small confectionery and biscuit firms typically feel economic pressures more sharply because they have less scale and less financial cushion

Impact | Explanation |

|---|---|

Inflation hits small firms harder |

|

Exchange rate volatility is a bigger problem |

|

Higher interest rates squeeze investment |

|

Tax and compliance can be costly |

|

Small firms can still find opportunities |

|

Unlock more, it's free!

Was this revision note helpful?