The Competitive Environment (Edexcel A Level Business): Revision Note

Exam code: 9BS0

The competitive environment

The UK confectionery and biscuits market is highly competitive, with intense rivalry between large multinational businesses, supermarket own-label products and smaller independent firms

Competition takes place across price, branding, product range, promotion and distribution, and is shaped by the maturity of the market

As most UK consumers already buy confectionery and biscuits regularly, businesses are not aiming to attract large numbers of new customers

Instead, they are competing to win market share from rivals, which increases competitive pressure

The confectionery market

Competitive element | Explanation |

|---|---|

Market concentration and rivalry |

|

Competition by segment |

|

Non-price competition |

|

The biscuits market

Competitive element | Explanation |

|---|---|

Market concentration and rivalry |

|

Value vs volume competition |

|

Competition from own-label |

|

Competition between multinationals and independents

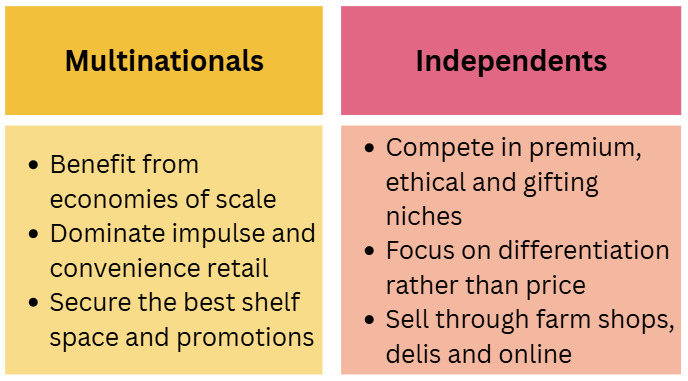

Competition between large firms and independents is unequal, due to differences in scale and resources

Independents rarely compete directly with multinationals, but instead avoid the most competitive mass-market segments

Barriers to entry

The competitive environment creates high barriers to entry, especially for small firms

Key barriers include:

strong brand loyalty to established names

high marketing and promotion costs

supermarket power over pricing and shelf space

economies of scale in production enjoyed by larger businesses

As a result, new entrants must usually:

target niche markets

offer ethical or premium differentiation

accept slower growth

Unlock more, it's free!

Was this revision note helpful?